Impeccable Timing

Timing is everything—even with medications coming to market. In the last few years new, effective treatments for the Hepatitis C Virus (HCV) have come to market as the death rates steadily climbed. Solvadi (12/2013) and Harvoni (10/2014) by Gilead Sciences; Viekira Pak (12/2014) by AbbVie and Zepatier (01/2016) by Merck are the main ones. They have cure rates over 90% in many cases. Although their prices have been sky high, according to the WHO, the production costs of these drugs are quite low. Harvoni prices were expected to drop, but I haven’t anything much cheaper than $94,500 for 12 weeks of medication. Viekira Pak lists at $83,300 for 12 weeks; Zepatier is the bargain at $54,600.

Timing is everything—even with medications coming to market. In the last few years new, effective treatments for the Hepatitis C Virus (HCV) have come to market as the death rates steadily climbed. Solvadi (12/2013) and Harvoni (10/2014) by Gilead Sciences; Viekira Pak (12/2014) by AbbVie and Zepatier (01/2016) by Merck are the main ones. They have cure rates over 90% in many cases. Although their prices have been sky high, according to the WHO, the production costs of these drugs are quite low. Harvoni prices were expected to drop, but I haven’t anything much cheaper than $94,500 for 12 weeks of medication. Viekira Pak lists at $83,300 for 12 weeks; Zepatier is the bargain at $54,600.

New CDC data in May of 2016 indicated that HCV deaths for 2014 reached an all-time high of 19,659. The rates have been steadily rising since 2010 when the total was 16,627. The CDC also stated their numbers were most likely a fraction of the deaths attributable in whole or in part to chronic hepatitis C. There are an estimated 2.7 to 3.9 million chronic cases of HCV in the U.S. New acute cases of HCV have also been steadily increasing. In 2014 there were 2,194 new cases of HCV reported, a 300% increase since 2005. The CDC suggested that actual cases are estimated to be 13.9 times higher than the number of reported cases in any year. The following chart was compiled from the CDC data.

|

2010 |

2011 |

2012 |

2013 |

2014 |

|

|

Actual New HCV |

853 |

1,230 |

1,778 |

2,138 |

2,194 |

|

Estimated New HCV |

11,800 |

16,500 |

24,700 |

29,700 |

30,500 |

|

Cause of Death as HCV |

16,627 |

17,721 |

18,650 |

19,368 |

19,659 |

A study done on the CDC HCV data found that from 2003-2013 the number of deaths from HCV surpassed the combined total of 60 other infectious conditions. This was despite the improving therapies now available. The HCV death statistics could begin decreasing in the next few years, as the impact of the new drugs is felt in treatment. But the high cost of medications has resulted in health insurance companies prioritizing treatment for the worst HCV cases. So as the heroin and prescription pain medication epidemic rages on, new HCV patients have to wait their turn until their HCV gets serious enough for their health insurance to approve treatment.

Despite enthusiasm for the new curative, brief (12-week), all-oral antiviral treatments for hepatitis C virus (HCV) infection, the continued health burden and increased mortality for HCV-infected patients in the United States remain underappreciated.

A CDC press release indicated the greatest HCV burden falls on baby boomers, born between 1945 and 1965. A study published in The Lancet Infectious Diseases in 2016 suggested injection and blood transfusion technologies were not as safe as they are today, so many boomers may have been unknowingly living with HCV for many years. Jonathan Mermin of the CDC said: “Why are so many Americans dying of this preventable disease? Once hepatitis C testing and treatment are as routine as they are for high cholesterol and colon cancer, we will see people living the long, healthy lives they deserve.” The outrageous price for HCV medications may be part of your answer, Dr. Mermin.

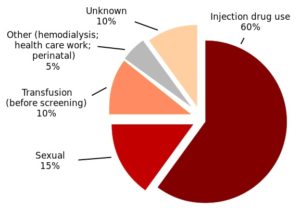

A Live Science article on the CDC study noted that HCV is primarily spread today through people sharing needles, syringes or other equipment used when injecting drugs. “But before 1992, when the U.S. began screening the blood supply for the virus hepatitis C was also commonly spread through blood transfusions and organ transplants.” The following chart from Wikimedia Commons, composed by Opigan13, was compiled from CDC figures. It shows data on hepatitis C infection by source.

HCV can be a “silent illness,” with people having no symptoms for decades. This allows the disease to progress unnoticed. Hepatitis C is “a different beast” from other liver infections that have more symptoms or are shorter in duration, according to Dr. Raymond Chung, director of hepatology and the Liver Center at Massachusetts General Hospital. Dr. Chung thought the increase in HCV deaths could continue for five more years or longer.

Amy Nunn, an associate professor of behavioral and social sciences at the Brown University School of Public Health said the rise in HCV deaths was alarming. About 85 percent of individuals who are infected with HCV don’t know they have it. Most people are not routinely screened for the virus. Nunn also pointed to the high cost of the new hepatitis C drugs as one reason that some people are having trouble getting access to them in the early stages of the disease.

A report by IMS Health for 2015 indicated that nearly 250,000 new patients received treatment for HCV in 2015. Added to the 170,000 new patients in 2014, the past two years have seen 5 times the number of patients than the previous three years combined. The majority of patients were treated by Medicare (50%); followed by commercial insurance (28%) and Medicaid (19%); 3% paid cash. Non-discounted spending over the past two years for the newer HCV drugs was $31.0 billion. “The discussion continues over the price of these medicines and the criteria for determining patient access and insurance coverage.” See chart 10 in the report for this data.

Spending on HCV went from so small an amount in 2013 that a figure couldn’t be shown in chart 8, to 12.2 billion in 2014 and 18.8 billion in 2015. Looking at the top medicines by spending in 2015, Harvoni was #1 with $14.3 billion. Solvadi dropped to 19th with $3.0 billion spent. In 2014 Solvadi had been tied for 1st with Humira at $7.8 billion in spending.

The World Health Organization (WHO) estimates that 130 to 150 million people globally have chronic hepatitis C infection. Around 500,000 people die yearly from HCV-related liver diseases. The most affected regions are Africa, Central Asia and East Asia. Populations at risk of HCV include: people who injects drugs, people who have used intranasal drugs, people who have tattoos or piercings, people with HIV, prisoners or previously incarcerated individuals, and children born to mothers with HCV.

The incubation period for hepatitis C ranges from 2 weeks to 6 months. After the initial infection, 80% of people do not show any symptoms. Individuals who are acutely symptomatic could exhibit “fever, fatigue, decreased appetite, nausea, vomiting, abdominal pain, dark urine, grey-coloured faeces, joint pain and jaundice (yellowing of skin and the whites of the eyes).” The WHO said:

Recently, new antiviral drugs have been developed. These medicines, called direct antiviral agents (DAA) are much more effective, safer and better-tolerated than the older therapies. Therapy with DAAs result can cure most persons with HCV infection and treatment is shorter (usually 12 weeks) and safer. Although the production cost of DAAs is low, the initial prices are very high and likely to make access to these drugs difficult even in high-income countries.

So pharmaceutical companies like Gilead Sciences, AbbVie and Merck are making enormous profits from their HCV treatments and will continue to do so for many years (see “Riding the Hep C Gravy Train”). The low production cost for HCV drugs is also an explanation for why Gilead Sciences was so willing to offer steep discounts to countries like Egypt (See “Is There No Balm in Gilead?” and “Hepatitis Hostages”)—it’s good PR and they either still make a profit or buy a lot of goodwill for a nominal cost. As Amy Nunn said, “This is an epidemic of enormous magnitude.” And it looks like it will be around for awhile longer. Gilead, Merck and AbbVie, your timing for drug development was impeccable.